Discover the Secret Conveniences and Advantages of Using Bankruptcy Solutions for Your Economic Circumstance

Navigating monetary difficulties can be a difficult job, particularly when encountered with overwhelming financial obligations and unsure monetary futures. These specialized solutions give an array of remedies made to reduce the concern of financial obligation, restructure monetary responsibilities, and pave the way towards a more secure financial structure.

Comprehending Bankruptcy Providers

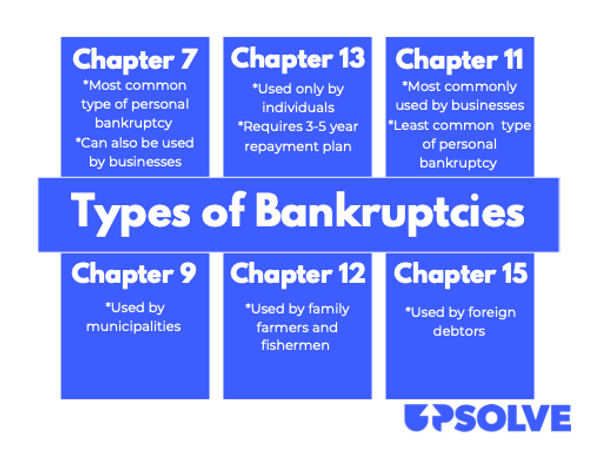

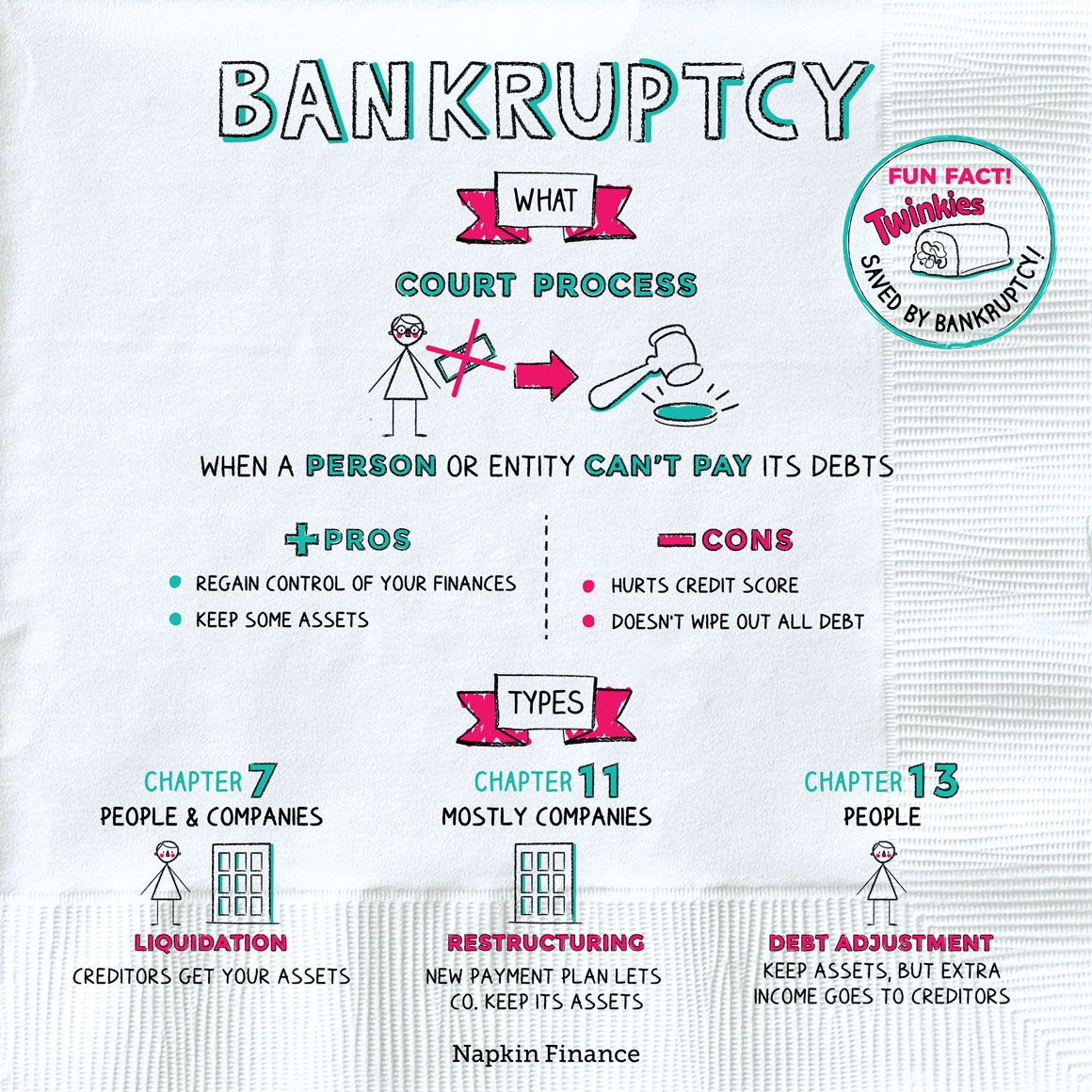

When encountering economic problems, companies and individuals can gain from recognizing bankruptcy services to navigate their situation effectively. Bankruptcy services encompass an array of services designed to aid individuals and businesses address economic challenges and reclaim security. These services frequently consist of financial obligation restructuring, negotiation with financial institutions, asset liquidation, and personal bankruptcy procedures.

By looking for help from insolvency experts, individuals can get a clear understanding of their financial choices and develop a critical plan to resolve their debts. Bankruptcy practitioners have the know-how to evaluate the economic situation, recognize the root creates of the insolvency, and advise the most ideal course of activity.

Additionally, understanding bankruptcy services can offer people with important understandings right into the legal ramifications of their economic situation. This expertise can help people make informed choices regarding how to continue and shield their passions throughout the bankruptcy procedure.

Financial Obligation Consolidation Solutions

Checking out efficient debt loan consolidation options can give people and businesses with a streamlined technique to handling their economic commitments. Financial debt combination includes integrating several financial obligations right into a solitary financing or payment plan, frequently with a lower rate of interest rate or prolonged payment terms. This method can aid streamline funds, lower the risk of missed repayments, and possibly reduced monthly payments.

One common debt combination remedy is a financial debt combination financing, where individuals or services obtain a round figure to settle existing debts and afterwards make single monthly payments in the direction of the new lending. Another alternative is a financial debt administration plan, where a credit report counseling agency works out with financial institutions to reduced rates of interest or waive charges, enabling the debtor to make one consolidated month-to-month settlement to the agency.

Negotiating With Lenders

Working out efficiently with creditors is an essential action in solving monetary troubles and finding viable services for financial debt repayment. When encountering insolvency, open communication with financial institutions is essential to getting to mutually useful contracts. By launching discussions with lenders at an early stage, companies or people can show their determination to attend to the financial debt issue properly.

Throughout negotiations, it's vital to give creditors with a clear introduction of your financial circumstance, consisting of income, costs, and properties. Transparency develops trust and boosts the possibility of getting to a beneficial result. Furthermore, proposing practical repayment plans that think about both your economic capabilities and the creditors' rate of interests can cause effective agreements.

Personalized Financial Assistance

Establishing a solid foundation for monetary healing involves seeking customized monetary support tailored to your particular conditions and objectives. Business Insolvency Company. Individualized monetary assistance plays an important function in navigating the complexities of insolvency and developing a tactical plan for regaining financial security. By functioning very closely with a monetary consultant or insolvency professional, you can acquire important insights into your economic scenario, recognize areas for improvement, and create a roadmap for attaining your economic goals

One of the vital advantages of individualized economic support is the chance to get tailored advice that considers your unique financial conditions. An weblink economic consultant can assess your income, financial obligations, expenses, and properties to give personalized referrals that line up with your objectives. This personalized strategy can assist you make educated decisions, prioritize your economic obligations, and produce a lasting monetary prepare for the future.

In addition, individualized economic guidance can provide continuous assistance and accountability as you function in the direction of improving your financial circumstance. By partnering with a knowledgeable advisor, you can get the confidence and know-how needed to conquer monetary challenges and develop a stronger monetary future.

Course to Financial Recuperation

Navigating the journey in the direction of economic recovery requires a critical technique and disciplined economic monitoring. To start this course efficiently, individuals have to first assess click to read their current financial situation comprehensively. This involves understanding the degree of financial obligations, examining income sources, and identifying expenses that can be trimmed to reroute funds in the direction of debt payment or cost savings.

When a clear photo of the monetary landscape is established, creating a sensible budget ends up being extremely important - Business Insolvency Company. Budgeting enables the appropriation of funds in the direction of financial obligation repayment while ensuring that essential expenditures are covered. It likewise serves as a device for tracking development and making necessary changes in the process

Conclusion

To conclude, making use of bankruptcy services offers numerous advantages and benefits for individuals facing financial difficulties. These services provide financial debt loan consolidation remedies, aid bargain with creditors, offer customized economic assistance, and lead the way in the direction of economic recovery. By seeking out insolvency services, people can take proactive actions towards improving their financial scenario and accomplishing long-lasting stability.

By working collaboratively with financial institutions, individuals and companies can navigate difficult economic circumstances and lead the means towards a much more secure financial future.

One of the key benefits of customized financial assistance is the opportunity to obtain tailored recommendations that considers your distinct financial conditions. These services give financial debt combination options, help negotiate with lenders, use personalized financial assistance, and pave the method towards economic recovery.